OK, this may not be the sexiest post in the Startup Lessons Learned series, but it’s about one of those things that’s so easy to ignore, or in my case, not even think about when bringing on new team members in different U.S. States - registering your business to do business in that state!

I casually mentioned in a recent board meeting (remember that post about productive board meetings?) that we were building our presence in the lovely city of Austin, Texas and my lawyer’s ears perked up. “Are you registered in Texas?” Emma asked. And semi-confidently, I replied that yes, although we are based in San Francisco, the great folks at ZenPayroll had prompted me to fill out some various forms when I was adding my Austin-based folks to payroll (BTW, we love ZenPayroll, it’s super easy to use, very complete and just a very well done & affordable app.) So I thought I was all done. Not so fast, she said.

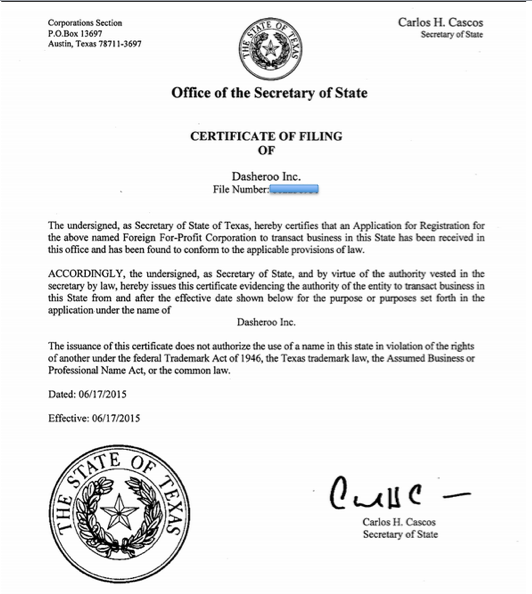

I also had to file a form to be ‘qualified’ to do business in the great state of Texas. It’s an Application for Registration of a For Profit Corporation (the TX Version). It’s an easy form to complete, and just asks for basic info like your business name & address, EIN #, names and addresses of company officers, and the address of the office (even if it’s a home office) in Texas. Oh yeah, plus $750 filing fee. And in about a week, Dasheroo was ‘legit’ to do business in Texas:

We now have our first team member in Georgia. And now I know! Even though ZenPayroll does an awesome job of prompting me with any new payroll-oriented forms to complete, including Department of Revenue (need that payroll tax income!) and Department of Labor forms, there’s still that business registration form that needs to be filed with the Secretary of State.

So especially if you’re building a distributed team for your new business, remember to always check to see if you’re required to register your business in that state. I’m pretty sure every state requires it. It’s more of a housekeeping task than anything else, but take care of it at the get-go, right when you’re adding your next team member in a new state. Plus you’ll avoid potential fines down the road. Who needs that?